SECU Total™ Checking & Rewards

One Account.

All the Rewards.

We’re making checking simple with SECU Total™ Checking & Rewards. It’s an all-in-one checking account with:

- No monthly maintenance fees

- Debit cash back

- Credit card rewards

- Competitive interest rates (Qualifying Platinum Level Members can earn up to 2.00% APY on Interest Rates)

- Additional interest on CDs

- Easy virtual banking

- No minimum balance requirements

- 50,000+ Free ATMs nationwide

- One order of free checks per year

- Combined balances for more rewards

- And more

Features and benefits

Let’s talk about some of the rewarding benefits you could receive with a SECU Total™ Checking & Rewards account. For the full list of benefits, click here.

Cash back and bonus points

Swipe your card and earn debit cash back** and bonus credit card rewards**** on points-eligible cards. Use our Cash Back Visa® Card and earn a $10 statement credit each month.

Higher interest on CDs

With SECU Total™ Checking & Rewards, you can receive higher interest on your 12 month CDs. Schedule a virtual appointment to open or renew your CD and reap the rewards.

Combined balances

All primary and joint account balances are combined and count towards your total benefits, so every account owner can enjoy the rewards.

Teen Checking now available

Teens, age 13-17, can open a checking account with a joint owner over 18 years old.

Checking that grows with you

As you grow, so do your financial wellness needs.

That’s why SECU Total™ Checking has four different rewards levels that reward you based on your account activity and participation, no matter where you are in life. Learn more about each level below and visit our rates page to view our current rates.

Bronze

Everyone starts here each month and levels up as requirements are met.

$25 minimum deposit to open your account

Silver*

$10,000+ combined deposit/loan balance

$3,500+ in a checking account

Gold*

$50,000+ combined deposit/loan balance

$10,000+ in a checking account

Platinum*

$100,000+ combined deposit/loan balance

$25,000+ in a checking account

| Rewards | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|

| Competitive Interest Rates (APY) |

up to 0.05% APY* |

0.10% APY* |

up to 0.15% APY* |

up to 2.00% APY* |

| No monthly maintenance fees |

|

|

|

|

| One order of free checks (per account per calendar year) |

|

|

|

|

| Easy virtual banking |

|

|

|

|

| 50,000+ Free ATMs nationwide |

|

|

|

|

| Earn additional interest on 12 Month CDs |

|

|

||

| Debit card cash back** |

|

|

||

| Mortgage closing costs rebates*** |

|

|

||

| Bonus credit card rewards**** |

|

Ready to get started?

Take the next step toward the one-for-all checking account that gets you the rewards you deserve.

Have questions? We have answers.

At the beginning of each month, all members start at the bronze level and level up once the requirements are met for the higher levels. Your reward level is calculated monthly (on the last day of the month), based on your balances and activity. Click the My Rewards icon within SECU’s online and mobile banking platform to view your current level, how to get to the next level and your rewards history.

Members age 13 – 17 with the proper identification can open a checking account with a joint owner who is over the age of 18. The teen checking account must be opened in a financial center or through our Virtual Financial Center. Note, members under the age of 18 are not able to open any SECU products online or through the mail.

Level qualification is based on three things:

- Meeting the balance requirement for that level either with your checking account alone, or with your combined deposit (savings, checking, money market, CDs, IRAs) plus loan balances (mortgages, home equity, personal loans, and credit cards), and any balances you have with our investment program partner. See more details here.

- E-statements (required for levels silver, gold, and platinum)

- Direct deposit of $500 or more per month into your checking account (required for levels silver, gold, and platinum)

You receive a specific rate that corresponds with your reward level, which is determined by account activity and your checking account balance. Your interest rate will be calculated as a blended APY at the end of each month, based on your average daily balance and reward level. This means that each portion of your balance receives a certain rate, so the more money you keep in your checking account, the more you earn.

Each rewards level is eligible for interest. In the bronze level, the portion of your balance above $1,000 earns interest.

Continue reading our more detailed checking FAQs here (PDF opens in new window) or schedule a virtual appointment today and we can walk you through it.

At the time of activation, you will be able to set your own PIN. To activate your card and set your PIN, follow the directions on the sticker attached to your new card.

Terms & Conditions

*APY = Annual Percentage Yield. APYs current as of 11/01/22. You must meet the criteria for each rewards level to receive the APYs and other rewards shown for that level. See current rates page. APY is calculated based on average daily balance and will be a blended rate. Rates and rewards subject to change at any time. Fees may reduce earnings on the account. Membership eligibility required. Only accounts in good standing are eligible to qualify for rewards.

Rewards level qualifications and benefits vary by level. At the beginning of each month, your account will reset to Bronze level until the monthly requirements are met. Your actual rewards level will be calculated on the last day of the month and can change monthly based on activity and balances.

You can view your current activity and rewards level, how to reach the next level and your rewards history at any time in online or mobile banking by clicking the “My Rewards” icon, or reviewing your monthly statement.

Level Qualifications

Balances: You can qualify for rewards levels in two different ways based on your balances with SECU. The higher of the two will determine your rewards level: 1) Combined Deposit/Loan Balances (“Qualifying Balances”). On the last day of each month, we add up the average daily balances of SECU accounts for which you are the primary or joint owner: deposit accounts (savings, checking, money market, CDs, IRAs) + loan accounts (mortgages, home equity, personal loans and credit cards) + any investment balances that you maintain with our investment program partner; OR 2) Checking Balance. We use the highest balance of any checking account for which you are the primary owner. E-statements & Direct Deposit: Levels Silver and above also require e-statements and full check Direct Deposit of $500 or more per month. Eligible Direct Deposits must be into one or more checking accounts for which you are the primary owner and include recurring payroll, social security and pensions.

Bronze: None, everyone starts here each month and levels up as requirements are met.

Silver: $10,000 in combined deposit and loan balances or $3,500 in one checking account + e-statements + full check Direct Deposit of $500 or more/month.

Gold: $50,000 in combined deposit and loan balances or $10,000 in one checking account + e-statements + full check Direct Deposit of $500 or more/month.

Platinum: $100,000 in combined deposit and loan balances or $25,000 in one checking account + e-statements + full check Direct Deposit of $500 or more/month.

Rewards Qualifications

Qualifying Platinum Members Earn Up to 2.00% APY

Requires members to be in the Platinum rewards level with e-statements and direct deposit of $500 or more into checking per month, as well as a balance of $75,000 or more in checking. Other rewards levels and balances will earn different APYs.

Interest: See current rates page for balances required to earn interest for each level. Platinum rate of 2.00% APY is available for balances over $75K for qualifying members. Your interest will be calculated as a blended APY. For example: If you are in the Platinum level and have a balance of $100,000, you will receive 0.10% on the first $3,499.99, 0.15% on the portion of your balance between $3,500 and $19,999.99, 0.50% on the portion of your balance between $20,000 and $74,999.99 and 2.00% on the portion of your balance above $75,000. This would result in a blended APY of 0.81%, if you maintain the $100,000 for the entire month.

**Debit Cash Back: requires 12 or more debit purchases per month, including Point of Sale and monthly subscription payments using your debit card (i.e. bill pay and gym memberships, etc.). Gold: 1% of your first $1,000 in purchases per month (max of $10/month); Platinum: 2% of your first $1,000 in purchases per month (max of $20/month). The cash back will post to your checking account on the last day of the month and will appear as “Debit Card Cash Back – Interest Adjustment” on your statement. Debit cash back is considered interest and will generate a 1099.

Higher Interest on 12 Month CDs: Gold and Platinum offer additional interest on 12 Month CDs. See current rates page. Gold and Platinum CDs are based on your highest reward level in the last 3 months and need to be opened at a branch, via mail, or through a virtual appointment. Previously opened CDs are not eligible. We may impose a penalty for early withdrawal on CDs.

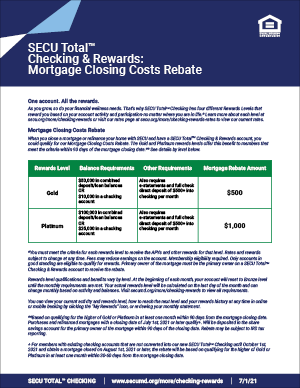

***Mortgage Closing Costs Rebates: Based on qualifying for the higher of Gold or Platinum in at least one month within 90 days from the mortgage closing date. Purchases and refinanced mortgages with a closing date of July 1st, 2021 or later qualify+. Primary owner of the mortgage must be the primary owner on a SECU Total™ Checking & Rewards account to receive the rebate. Will be deposited in the share savings account for the primary owner of the mortgage within 90 days of the closing date. Rebate may be subject to IRS tax reporting. Maryland Mortgage Program (MMP) loans and Home Equity Line of Credit (HELOC) products do not qualify for the rebate.

+ For members with existing checking accounts that are not converted into our new SECU Total™ Checking until October 1st, 2021 and obtain a mortgage closed on August 1st, 2021 or later, the rebate will be based on qualifying for the higher of Gold or Platinum in at least one month within 30-60 days from the mortgage closing date.

****Bonus Credit Card Rewards: Platinum offers bonus credit card rewards when you make at least 12 credit card purchases per month with a SECU Visa® credit card. All eligible cards will receive 1,000 bonus points per month. Bonus rewards will appear in your UChoose Rewards account in the following month.

Free checks: each account (at any level) can order 1 free box of SECU style checks per calendar year.

Members: Ready to Track Your Rewards?